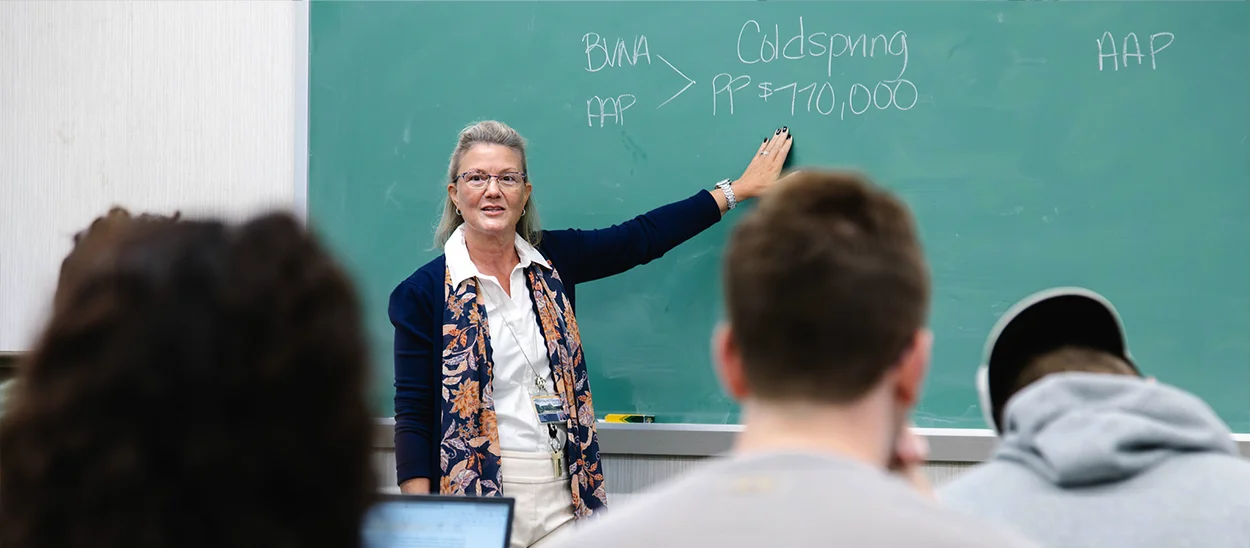

Investment I: Securities Explore the fundamentals of investing and financial markets in this introductory course. Topics include the time value of money, investment principles, market structures, and techniques for analyzing and valuing bonds and stocks. You'll also learn about interest rates, duration, and both fundamental and technical analysis—building a solid foundation for smart financial decision-making.

Financial Institutions This course explores the role financial institutions play in the economy, focusing on how they manage assets and liabilities, navigate regulations, and operate within financial markets. You'll examine interest rate structures and gain insight into how theory connects with real-world financial practices.

Investments III: Alternative Assets Gain an introduction to alternative investments and their role in portfolio management. You'll explore asset classes like hedge funds, private equity, private debt, and real assets, along with their performance, fee structures, and valuation techniques. The course also covers asset class-based portfolio strategies and the rationale behind diversifying beyond traditional investments.